Global construction equipment sales to hit low in 2025, recover from 2026

26 March 2025

Sales of constriction equipment will hit the bottom of its current cycle this year, according to a new forecast from specialist consultant Off-Highway Research.

Global construction equipment sales are forecast to hit their lowest point in 2025. Image: Adobe Stock

Global construction equipment sales are forecast to hit their lowest point in 2025. Image: Adobe Stock

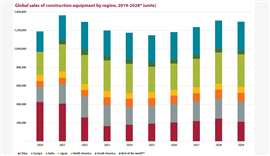

According to Off-Highway Research global sales declined by 2% in 2024, a milder decline than previously anticipated. A further -2% drop is expected in 2025, before growth returns from 2026 onwards.

Off-Highway Research managing director, Chris Sleight said, “Equipment sales in the developed markets of Europe, Japan and North America all fell last year, and Europe had a particularly hard landing. However, this was partially offset by growth in many emerging markets, with India performing particularly well.

He continued, “The recovery should start to take root and become more widespread this year. However, we expect another fall in equipment sales in North America, which will pull down the global total.”

The European equipment market fell 17% last year, with every country except Ireland seeing a decline in sales. A depressed housebuilding market was particularly problematic for sales of compact equipment, while the collapses of the Austrian, French and German governments towards the end of the year were particularly damaging for business confidence in those countries. As the largest and third largest equipment markets in Europe, the sharp declines in Germany and France were particularly damaging.

With business confidence remaining weak and geopolitical tensions high, a modest 1% improvement in sales is expected in Europe this year.

Equipment sales in North America were down 5% last year, a shallower decline than was previously expected. The construction market remained strong. However, after three consecutive years of record high sales from 2021 to 2023, fleets had become saturated with young equipment.

This year’s anticipated 11% decline in sales reflects not only the on-going return to normal sales volumes, but also the damage to business confidence being done by the Trump administration’s inflationary import tariffs and the unpredictability of its policy making.

Growth markets for construction equipment sales

Most emerging markets saw increased sales last year. In China there was a 9% increase in sales, albeit from the artificially low level of 2023, which was caused by the real estate market crash.

What growth there was in China last year was driven almost entirely by electric construction equipment sales, which in that market tend to focus on larger machines for mining and quarrying applications. China accounted for 80% of the world’s electric construction equipment sales last year.

A further 7% increase construction equipment sales is expected in 2025, but the volumes will still remain below their natural level.

In India, despite the disruption of a general election, the construction equipment market grew 9% in 2024. Besides general market buoyancy, a new emission law which came into force at the start of 2025 drove a surge in sales towards the end of 2024, as buyers sought to avoid the higher equipment prices which the regulation entails.

South America suffered a sharp downturn in sales in 2023 from the exceptional high seen in 2022. High inflation and high interest rates contributed to the downturn, but with these factors easing in 2024, the market achieved 1% growth. A modest slowdown in South America is expected this year.

Markets in the rest of the world grew 4% last year, with high commodity prices providing a lift to the economies of many of these countries.

CONNECT WITH THE TEAM