India’s construction equipment market is growing rapidly. But will Chinese OEMs emerge the winners?

14 March 2025

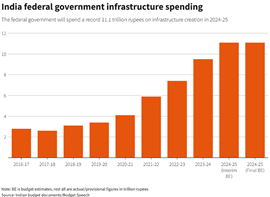

India’s construction equipment market is not just growing — it is evolving. With rapid urbanisation, massive infrastructure projects and a shift towards advanced technology, the country is outgrowing all other markets. With data sets supplied from Off Highway Research, commercial vehicle consultancy, abcg’s Alan Berger and Robert Droogleever examine the key takeaways.

When many of us think about fast growing construction equipment markets, the one standout over the last two decades has been China. And certainly, while China has had periods of explosive growth, it has also experienced equally dramatic downturns.

Less showy, perhaps, and often overshadowed by its high-profile neighbor, the overlooked star when it comes to consistent and rapid equipment growth is actually the world’s most populous country – India.

With some 1.5 billion people to provide for, investment in infrastructure in India has been increasing consistently over the last decade, leading to a consequent compound annual growth rate in demand for construction equipment over the same period of 10%. This makes India the hottest growth global market, especially when compared to the 2% global growth rate. While all markets have cycles, India has steadily grown, with only the occasional pause.

Source: Off-Highway Research and abcg

Source: Off-Highway Research and abcg

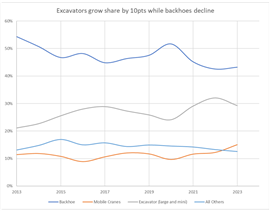

India’s product mix gradually changing

In an example of its exceptionalism, the Indian market has long been dominated by backhoe loaders and, to a lesser degree, by the unique mobile cranes so favored by Indian operators. Indeed, backhoes continue be the construction equipment of choice for the smaller Indian owner operator. However, as more large infrastructure projects need greater efficiency and faster delivery, the product mix of the Indian industry is morphing into one more closely resembling that of other developed regions.

As in the rest of the world, the inexorable rise in excavators is now happening in India, with their share of the domestic market increasing by nearly 10% over the last decade – at the expense of backhoe loaders, whose share has declined by even more. This is following a very similar trajectory to that of the maturing Chinese construction equipment market. The current excavator industry in India is probably already larger in value terms today than the backhoe loader market, and by 2030 we expect that excavators will also outsell them in numbers sold.

But, given the unique hold the humble backhoe has on the affections of Indian contractors, we do not expect it to decline as far or as fast as happened in the US and Europe since their high-water mark in the 1980s.

One other area where the Indian market stands apart is shunning equipment popular in the US and Europe – such as compact track loaders and wheeled loaders, which are all rarities across the Indian subcontinent. This could change as the influence of Chinese OEM’s importing low cost wheeled loaders into the country takes hold. Indeed, Chinese manufacturers already have half of the fledgling Indian wheeled loader market.

Source: Off-Highway Research and abcg

Source: Off-Highway Research and abcg

A shift in the big players

With the growth in excavators has come a shift in the players influencing the market. Many global brands are positioning themselves to participate in this industry, but there is one clear set of winners.

Fully one third of the growth in excavator volume over the past decade has come from Chinese manufacturers, such that they now comprise over 20% of the total market. Excavators are not completely new to India, but domestic manufacturers, along with their more established foreign joint venture partners, have singularly failed to capitalise on this shift, despite their inherent home advantage – consequently losing share. One reason for this is that developing a ‘cost-optimised’ (i.e. cheaper) local variant of a global machine design is difficult to do, so even the once dominant Japanese excavator players are not capitalizing on the growth in India.

Compounding this is that Chinese machines are increasingly striking a balance of productivity, quality and cost that meets the needs of contractors in India. Other manufacturers are going to have to develop unique variants that are ideally suited to the Indian market and produced in India if they wish to stem the seemingly otherwise inevitable takeover by the Chinese OEMs.

The Indian market continues to have strong growth, with a more mature and broader mix of products. After decades of being focused on China, winning in India is set to become the new growth battleground for all construction OEMs.

Source: Off-Highway Research and abcg

Source: Off-Highway Research and abcg

CONNECT WITH THE TEAM