Trendlines: China bright for electrics but not North America

01 July 2024

While electric equipment sales glow with promise in China and glimmer in Europe, North American prospects are dim, says Off-Highway Research

Off-Highway Research has published a ground-breaking study on markets around the world for electric construction equipment. Adoption has been surprisingly high in China, and Europe is showing glimmers, but volumes are low in North America and the outlook is poor.

Chris Sleight, managing director, Off-Highway Research.

Chris Sleight, managing director, Off-Highway Research.

The new report looks at sales of machines that have traditionally had a diesel engine, but for which battery-electric and tethered electric variants are starting to become available.

It considers six groups: compact track loaders, crawler excavators, mini excavators, telescopic handlers, wheeled excavators and wheel loaders. It doesn’t include machines that have long been electrified, such as scissor lifts.

Globally, there were just under 7,300 electric construction machines sold last year, the majority of which were mid-sized wheel loaders in China. That represented a penetration rate for electric equipment of 0.6% worldwide.

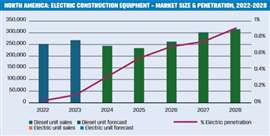

If that sounds low, electric sales in North America last year were barely above 250 units, a mere 0.07% of the market. These were almost entirely small machines with an operating weight of 10 metric tonnes (22,000 lb.) or less. The most popular were compact track loaders and mini excavators.

Pessimistic outlook

Off-Highway Research’s forecast is not optimistic. Although growth rates will be good – the compound annual growth rate (CAGR) for electric equipment is expected to be above 50% – volumes will remain insignificant. Essentially, if you’ve got nothing and it grows by 50%, you’ve still got nothing.

Source: Off-Highway Research

Source: Off-Highway Research

In numbers, the forecast is for electric equipment sales to approach 3,000 units a year, a penetration rate of 1%, by 2028.

Why so pessimistic?

One barrier to adoption is that there are not many electric machines available; the pace of introduction is expected to remain slow; and those that are available are more slanted towards European markets than North American ones. The exception is the compact track loader, which is almost exclusively bought in North America.

The second problem is that the focus on rental does not play to the strengths of electric equipment. The economic argument is built on total cost of ownership, including lower energy costs. But compact equipment is mostly sold to rental companies, who will not see this benefit.

A further issue is that fuel taxes are lower in North America than Europe, so the economic argument is harder to make.

Tariffs make it tougher

Finally, the blanket tariffs announced in May on Chinese electric vehicles include construction equipment in the definition, and this means such imports will be subject to 100% tariffs. This could move the current 2.5-3 times price multiple compared to diesel machines to as much as 5-6 times the cost of a traditional machine.

This not only affects Chinese brands, but international OEMs that manufacture their electric equipment in China.

And let’s not even start on the tensions between green advocates such as the U.S. Environmental Protection Agency and California, which are at loggerheads with some other states and parts of the business community.

About the Report

As the leading supplier of market information and forecasts to the construction equipment industry, Off-Highway Research has undertaken an extensive research program among all leading worldwide suppliers of electric equipment to understand the market size and the outlook for the industry. Below is a brief analysis of the report’s findings.

Click here for more information on The global electric construction equipment industry market report.

CONNECT WITH THE TEAM