IC Transport 50 2024: the world’s largest specialized transport companies

12 August 2024

For this, the 20th Anniversary iteration of the IC Transport 50 ranking of the world’s largest specialized transport companies, it is much more of a mixed result than the last one. Alex Dahm reports.

- There are 4,135 more people working at the top 50 companies than last year.

- The number of tractor units is up by 478 compared to last year.

- There are 259 fewer depots in 2024 than last year.

- The total capacity of specialized trailers is up by 57,749 tonnes.

- Modular equipment total capacity is down by 54,931 tonnes.

This year’s total IC Transport Index, of the top 50 companies, is up but only by a very small amount: 0.14 per cent.

Al Faris had the job of weighing, moving and loading out 19 modules, each weighting up to 950 tonnes, in Sharjah, UAE. (Photo: Al Faris)

Al Faris had the job of weighing, moving and loading out 19 modules, each weighting up to 950 tonnes, in Sharjah, UAE. (Photo: Al Faris)

Having said that, it is still up by 2,800 points which means an extra 2,800 tonnes of capacity is available. Last year the 2023 table was up by 5 % or a whopping 102,000 tonnes. It was also up in literally every parameter. Not the same can be said for this year.

The lack of significant overall increase this year was due to a reduction in the total capacity of heavy duty modular equipment, including self propelled modular transporter (SPMT). This category’s total was down by 4.65 %, or 54,931 tonnes, to a total of 1,127,415 tonnes. Talk in the industry for some years had been of a glut of this type of equipment so maybe this has now been corrected, at least among the top 50 companies.

Perennial T50 leader Mammoet, for one, certainly dropped a chunk last year, reducing its count of modular equipment, by 94,975 tonnes. That is more than 8 % of the combined total of all the modular kit in the Top 50. Second place Sarens, however, added more than 7,000 tonnes to its modular fleet, making the total 126,040 tonnes.

Around the world many small companies, likely too small for this top 50, have been buying this type of modular equipment for the first time, in a bid to enter this heavy load moving sector.

Specialized upturn

A small part of Fagioli’s major recent project involving a catamaran arrangement of vessels with SPMT and doubled heavy lifting gantry with strand jacks. (Photo: Fagioli)

A small part of Fagioli’s major recent project involving a catamaran arrangement of vessels with SPMT and doubled heavy lifting gantry with strand jacks. (Photo: Fagioli)

Turning to the specialized trailers total for the top 50, this was up, by an impressive 6.79 % (57,749 tonnes), to a total of 908,177 tonnes. This is 35 % higher than it was ten years ago whereas the modular equipment fleet total is up by 25 % in the same ten year period.

Again, however, Mammoet also reduced its fleet of this type of equipment, by about 4,000 tonnes. This was about 20 % of its total 20,311 tonne total in 2023.

Among the top 50 companies the number of employees has increased significantly once again. This year the rise is by 7.8 % to 57,081 people, up from 52,946 in 2023. For the two previous years the number also increased by more that 6 % each year.

Another increase is the number of tractor units, up by 478, or 1.78 %, to a total of 27,347. This has increased each year since 2020.

It is interesting to note there has been a significant reduction in the number of depots among the top 50 companies. In 2023 there were 2,495 depots and in 2024 this is down by 10.4 % to 2,236.

Placings

Transport specialist Laso from Portugal has been investing heavily in its fleet of equipment for wind work. (Photo: Laso)

Transport specialist Laso from Portugal has been investing heavily in its fleet of equipment for wind work. (Photo: Laso)

Of the total 86 entries, up from 84 last year, we welcome three new entries, Aguado (in at 37th place) from Spain, BOSS (in at 50th place) from the USA and, highest placed of all, Sinopec from China, in at 23rd place.

In the top ten this year there has been more movement than usual, although not in the first three positions, still Mammoet, Sarens and Fagioli. Next, however, the All family of companies has moved up from 8th, displacing Landstar into 5th. NTC from India then gained a place in 6th.

Next, Barnhart gained two places in 7th, having acquired three companies early in the year. Down two places is Daseke, recently acquired by TFI International for US 1.1 billion. It will become part of its new owner’s Truckload segment. Dubai-headquartered Al Faris, a new entry last year in 11th place, has made it into the top ten.

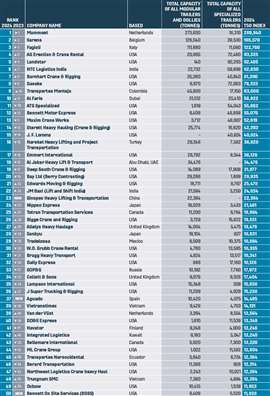

THE TRANSPORT 50

The Transport 50 Index is calculated using the total carrying capacity in metric tonnes of all specialized transport equipment in a company’s fleet. The two main sections are: specialized trailers; and modular trailers and SPMT.

It is very much a work in progress and will always be evolving and changing. We largely rely on the submission of entry forms completed by the companies listed. We are always interested to hear from companies that have not yet entered the Transport 50. If yours is one of them, please let us know and look out for the 2025 Transport 50 entry forms and calls for entries on the KHL web site during the second quarter of the year. You are welcome to inquire at any time about the next T50. Already a valuable reference, with your help the Transport 50 will continue to improve, hopefully one day expanding sufficiently to become the T100.

The complete IC Transport 50 Index for 2024.

The complete IC Transport 50 Index for 2024.

CONNECT WITH THE TEAM