When does construction waste become a marketable product?

09 October 2024

Excavator clears away rubble after demolition works. (Photo: DedMityay via Adobe Stock)

Excavator clears away rubble after demolition works. (Photo: DedMityay via Adobe Stock)

When is construction waste no longer considered to be waste?

That’s the question that industry figures from across Europe have been grappling with as they contributed to a new report on the issue.

The European Commission commissioned the report with the aim of potentially setting European Union (EU)-wide criteria that define when recycled or reused materials cease to be waste and instead become a marketable product or a secondary raw material.

And it’s an important question, when you consider that construction and demolition account for by far the biggest single waste and by-product stream in the European Union, accounting for more than a third of all its waste.

The theory is that setting so-called ‘end-of-waste’ (EoW) criteria will boost confidence in recycled and reused products, increasing the size of the market for them and promoting a circular economy. They could also help to provide legal certainty for businesses as well as reducing carbon emissions and improving environmental protection.

With that in mind, the report set out to assess which out of 10 different common waste products generated by the industry best lend themselves to the creation EoW of criteria.

Those 10 streams are:

- Aggregates

- Concrete

- Asphalt

- Fired clay bricks

- Wood

- Gypsum

- Plastic foam insulation

- Inert insulation

- Building products for reuse

- Rigid plastics (PVC for rigid plastic pipes and window frames)

Over the course of nearly two years (from December 2022 until March this year), researchers working on the project met, surveyed and interviewed over 100 industry stakeholders.

Using stakeholders’ feedback, they attempted to understand how much support there was for EoW criteria across the different categories, what the current material reuse and recycling rates are for different categories of waste, and what uses exist for reused and recycled materials.

Among many other factors, they also considered the estimated EU market value for the different types of products, the level of demand for them, how much those materials are being shipped within the EU and outside of it, how the market could evolve in terms of value and sales, and the expected environmental and human health benefits.

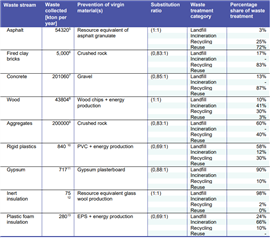

Input data used by the report for an impact analysis, showing recycling and reuse levels by waste stream under a ‘business as usual’ scenario.

Input data used by the report for an impact analysis, showing recycling and reuse levels by waste stream under a ‘business as usual’ scenario.

The results

Plugging the findings from all of those considerations into a series of different calculations helped the researchers to build a picture of which materials have the highest potential for possible future EU-wide EoW criteria.

The report found that those with the highest potential are:

- Aggregates

- Concrete

- Fired clay bricks

- Gypsum

Meanwhile, they found there was “average potential” for:

- Asphalt

- Inert insulation

- Plastic foam insulation

- Rigid plastics

- Wood

An outlier was the broad (and possibly ill-defined) category of ‘building products for reuse’ which did not appear to lend itself well to such criteria.

Broad consensus?

The report’s authors concluded that “the majority of stakeholders would be in favour of future European EoW criteria for the construction and demolition waste (CDW) streams investigated”.

But only in the case of clay fired bricks were stakeholders unanimous on that point.

In many cases, they agreed that criteria would lead to clear material status, less administration, environmental benefits and an improved market.

But when asked about their support for end-of-waste criteria for the nine other CDW streams, there were at least some voices in each who raised concerns.

Among the disadvantages to the idea that they highlighted were the fact that markets where EoW criteria already exist could be disrupted.

Image: altitudevisual via AdobeStock - stock.adobe.com

Image: altitudevisual via AdobeStock - stock.adobe.com

France, Ireland, Italy and the Netherlands have all already established EoW criteria for aggregates, for example. The Flanders region of Belgium is also developing its own.

And in Italy and the Netherlands, while there are no existing EoW criteria for asphalt, the EoW criteria for aggregates can be applied on asphalts if part of the asphalt is manufactured as an aggregate.

That meant that some stakeholders viewed it as important that future European criteria took existing national and regional criteria into account to minimize the bureaucratic burden.

And in the case of rigid plastics, opponents to the idea of EoW criteria mentioned that older PVC products have a high content of harmful chemicals, making it technically difficult and potentially harmful to reintroduce them to the manufacturing process.

When it came to wood, where recycling is already high, one opponent suggested that EU-wide criteria would not bring about significant change. And in the case of gypsum, one opponent claimed that recycling already takes place.

Recycling and reuse challenges

In general, stakeholders also noted that recycling and reuse of construction materials presents significant challenges – although the fact that so many challenges exist strengthens the case for the development of EU-wide end-of-waste criteria, according to the report.

Common challenges include the contamination of materials, such as mortar and plaster on fired clay bricks, and flame retardants in gypsum. Then there is the challenge of ensuring consistent quality of recycled materials, a lack of demand, and economic disincentives such as inadequate landfill fees and the lower cost of virgin materials.

The report concluded, “In general, the input provided a positive picture of the potential environmental and economic impacts associated with the introduction of EU-wide EoW criteria for CDW, together with a positive market attitude.”

At this stage, there are no concrete plans to introduce EU-wide EoW criteria to Europe’s construction and demolition industry. But the publication and its recommendations mean that the European Commission could take further steps towards them.

To read a full copy of the new report click here.

CONNECT WITH THE TEAM