Why France’s construction industry faces a difficult year ahead

13 October 2023

The French construction industry is facing headwinds that mean it could be in for a difficult year ahead, says Scott Hazelton of IHS Markit.

Construction work on the Olympic village for the Paris 2024 Olympics (Image: Arnaud Paillard via AdobeStock - stock.adobe.com)

Construction work on the Olympic village for the Paris 2024 Olympics (Image: Arnaud Paillard via AdobeStock - stock.adobe.com)

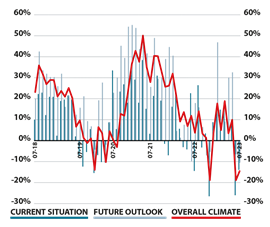

Operating conditions across the French construction sector worsened in August with activity weighed down by weak demand and a sharp decline in new business, according to the latest HCOB PMI data compiled by S&P Global.

Sentiment among construction firms remains downbeat, and companies reined in their purchasing activity. Higher prices for materials impeded input buying, as the rate of cost inflation accelerated midway through the third quarter.

While slower than that seen over the last two-and-a-half years, the uptick in inflation came in conjunction with a renewed deterioration in vendor performance.

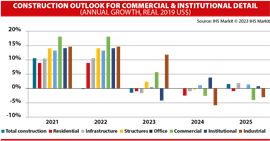

We expect real total construction spending in France to contract 1.5% in 2023. Given the lagged effects of interest rate hikes by the European Central Bank (ECB), construction spending is projected to fall by another 0.1% in 2024.

Source: IHS Markit

Source: IHS Markit

Leading indicators such as real gross value added (GVA) show that the construction sector entered a technical recession during the second quarter of 2023, according to data from the National Institute of Statistics and Economic Studies (INSEE).

Construction GVA fell 1% quarter over quarter in the second quarter of 2023, after a 0.3% drop in the first quarter.

Residential will be the main drag on overall sector growth in 2023, with real spending forecast to fall by 2.5%, followed by a further 0.9% in 2024, as the squeeze on households’ budgets from high inflation and rising interest rates, as well as tighter lending standards, leads to lower housing demand.

In the first quarter of 2023, 19,500 new homes marketed by property developers in France were reserved by individuals, according to figures from the Ministry of Ecological and Solidarity Transition. This represents a fall of 13.3% on a quarterly basis and concerns both new construction and new rehabilitated or renovated housing. This also marks the fourth consecutive quarter of double-digit decline.

At the same time, the number of newly marketed homes was 24,700 in the first quarter, 8.8% lower than the previous quarter and 14.4% lower than a year earlier. The annual growth rate of new housing loans to households has also been slowing since mid-2022 amid higher interest rates.

Echoing this, the ECB’s Bank Lending Survey showed that French banks continued to report a substantial net decrease in demand for loans for house purchases in the second quarter of 2023. Data from INSEE showed that the total number of dwellings authorised in France, excluding Mayotte, fell 27.4% in the first half of 2023, compared with the same period in 2022, while the number of starts fell 16.0%.

In non-residential structures, construction spending is expected to decline 0.3% in 2023 as investors adopt a “wait and see” approach amid tighter financial conditions and economic uncertainty and remain flat (0.0%) in 2024. Recent data from INSEE showed that authorised floor area of all nonresidential buildings in France fell by 3.6% in the first half of 2023 compared with the same period in 2022, while non-residential construction starts in terms of floor area fell 19.8%.

Infrastructure construction spending is likely to decline 1% in 2023, before rising 1.8% in 2024. Medium term growth will be underpinned by the €100 billion “France Relance” recovery plan. Of the total, €39.4 billion will be financed by the European Union for the country’s National Recovery and Resilience Plan (NRRP). The NRRP includes €4.4 billion for modernizing railways. In addition, the segment will benefit from several new railway projects, including the €25 billion Turin-Lyon high-speed link between France and Italy.

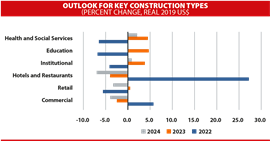

The outlook for industrial facilities construction post-2023 is grim, while office shows very weak growth. For industrial, there is some base effect decline after several years of decent growth, but we also expect weakness due to the overall economy.

Office will take years to recover from the remote work transition, with most construction spending either for renovation or new prime office space.

Within commercial, there has been a strong recovery in hospitality, but we expect that post-pandemic bounce to end with a weak global economy limiting travel and tourism.

Retail construction faces a prolonged decline due to e-commerce penetration. Institutional construction will be counter-cyclical with growth coming in both education and healthcare after 2022 declines.

CONNECT WITH THE TEAM