US equipment makers’ encouraging return to growth

14 March 2023

Photo courtesy of AEM

Photo courtesy of AEM

The Association of Equipment Manufacturers (AEM) said the US equipment manufacturing industry returned to growth in 2022, and its wider economic impact can be significant.

The association issued a report prepared by the Market Intelligence Team at S&P Global and details the impact of three major sectors – agriculture, construction, and mining – that make up the equipment manufacturing industry. ahead of the association’s largest trade show, ConExpo-Con/Agg 2023.

Key findings from the AEM Economic Impact Report include:

- The equipment manufacturing industry supports 2.35 million jobs, including direct, indirect, and induced employment, in the US.

- The industry directly employs approximately 427,000 American workers.

- The equipment manufacturing industry comprises 11% of the total US manufacturing employment base, or one in nine US manufacturing jobs.

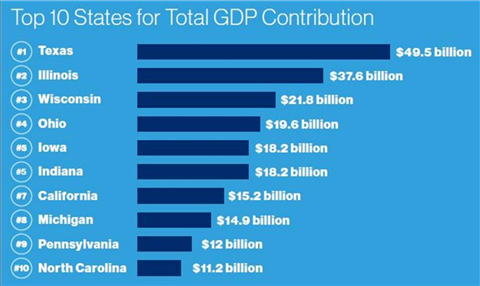

- The equipment manufacturing industry contributes $316 billion to US GDP annually.

On average, equipment manufacturing jobs pay 33% above the national average.

Equipment manufacturing supports more than 1000 jobs in 44 states, with a total employment impact of more than 10,000 in 32 states. The top 10 states support a total of 1.6 million jobs.

Photo courtesy of AEM

Photo courtesy of AEM

Return to growth for the equipment manufacturing industry in 2022 is part of a broader rebound in US manufacturing output, which saw nominal output increase by an estimated 14% in 2022.

The 4.2% employment growth seen by the equipment manufacturing industry in 2022 outpaced broader manufacturing-employment growth of 3.8% seen last year.

“Equipment manufacturers, like many other sectors in the US economy, have weathered economic uncertainty during a global pandemic,” said Rod Schrader, 2023 AEM chair and Komatsu North America chairman and CEO.

“But we answered the call and kept our factory floors open to produce the equipment that kept critical people and goods moving. We got the job done. This report is a testament to the grit and resiliency of the 2.35 million men and women who build, power, and feed America.”

Rebounding global supply chains and increased availability of raw materials have helped US manufacturing turn a corner. The Global Supply Chain Pressure Index, maintained by the Federal Reserve Bank of New York, hit an all-time high in November 2021, but by February 2023 it had retreated to just below the historical average. This suggests that on average, global supply chain conditions have begun to return to normal.

But persistent labor shortages and low inventories still pose a risk. AEM said semiconductor inventories have grown to an average of 50% of their optimal inventory levels, electrical breakers are at 40% of optimal, and rubber tracks are at 10%, but the next few years should see steady output growth.

“Fueled by a legacy of grit and ingenuity, America’s equipment manufacturers can outcompete anyone, but we need the right mix of policies to continue to bolster manufacturing in America,” said Kip Eideberg, AEM senior vice president, Government and Industry Relations.

“With expanded opportunities to sell our products overseas, immigration reform that addresses our workforce needs, and improvements to the federal permitting process, equipment manufacturers can continue to invest in their communities, grow their businesses, and hire more Americans.”

CONNECT WITH THE TEAM