U.S. construction spending surprises with November rebound

09 January 2023

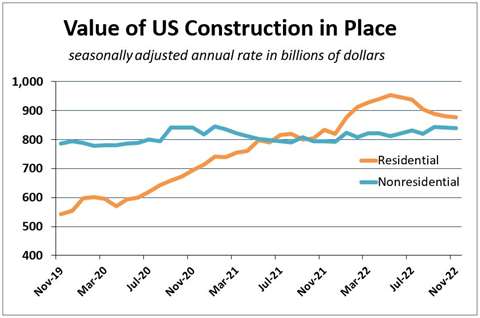

Residential construction spending has been sliding for six quarters but is 46% above its pre-pandemic peak. Investment in single-family home construction plunged nearly 18% since the Fed’s first rate hike of 2022 in May. (Data: U.S. Department of Commerce)

Residential construction spending has been sliding for six quarters but is 46% above its pre-pandemic peak. Investment in single-family home construction plunged nearly 18% since the Fed’s first rate hike of 2022 in May. (Data: U.S. Department of Commerce)

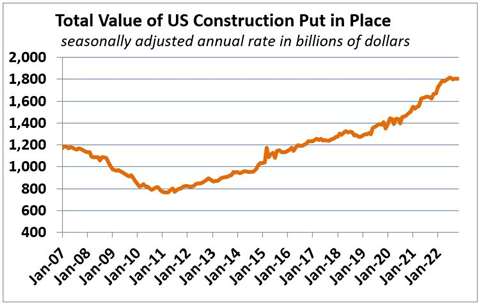

U.S. construction spending unexpectedly rebounded in November, lifted by gains in nonresidential structures, but single-family homebuilding continues to be hammered by higher mortgage rates.

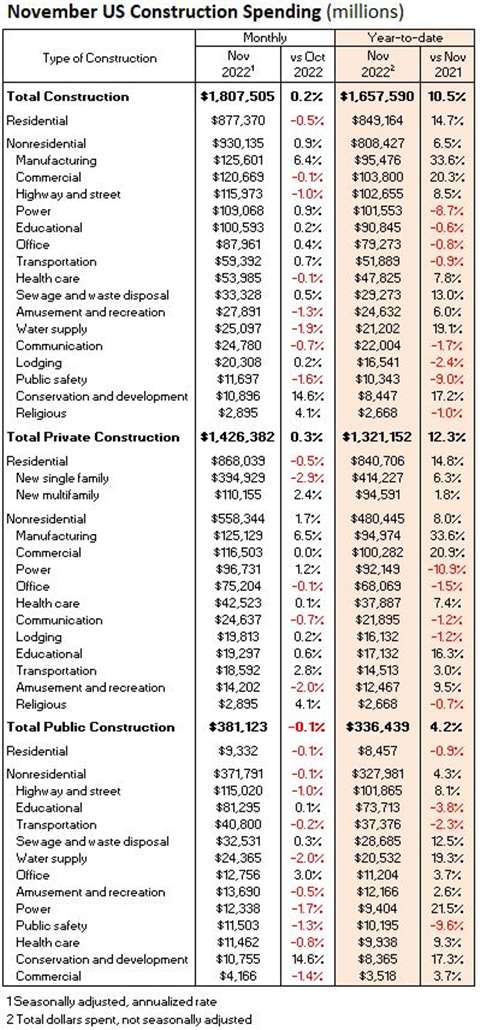

The Commerce Department said the seasonally adjusted annual rate of construction spending edged up 0.2% in November after slipping 0.2% in October. Economists polled by Reuters had forecast construction spending would decrease 0.4%. Actual year-to-date construction spending increased 10.5% compared to the first 11 months of 2021.

Spending on private construction projects rose 0.3% after declining 0.7% in October. Investment in private non-residential construction grew 1.7%.

A single-family plunge

Spending was up in nine of the 16 nonresidential categories, and while a 1.0% slip in highway and street construction made for a bad public-spending month in Novmeber, outlays in the category have jumped nearly 15% since the signing of infrastructure legislation in November, 2021. (Data: U.S. Department of Commerce)

Spending was up in nine of the 16 nonresidential categories, and while a 1.0% slip in highway and street construction made for a bad public-spending month in Novmeber, outlays in the category have jumped nearly 15% since the signing of infrastructure legislation in November, 2021. (Data: U.S. Department of Commerce)

Outlays for residential construction slipped 0.5%, drawing residential construction spending down to a seasonally adjusted annual rate of $877.4 billion. Residential investment has contracted for six straight quarters, the longest such stretch since the housing market collapse in 2006. But the November housing total remains more than 46% above its pre-pandemic peak.

Spending on single-family housing construction dropped 2.9% for the month. That outweighed increases of 2.4% in multifamily construction and 1.3% in additions and renovations to owner-occupied houses.

The Federal Reserve’s battle to tame inflation with the fastest interest rate-hiking cycle since the 1980s is throttling single-family housing. While total residential construction spending has fallen a little more than 8% since the Fed’s first rate hike of the year in May, single-family spending has plunged nearly 18%.

Year-to-date, spending on single-family construction is 6.3% above the first 11 months of 2021.

The average 30-year fixed mortgage rate, which breached 7% in October for the first time since 2002, has resumed its upward trend after briefly pulling back in late 2022, data from mortgage finance agency Freddie Mac showed. The rate averaged 6.42% last week, up from 6.27% in the prior week. It averaged 3.11% during the same period in 2021.

Significant nonresidential stability

Spending increased in November in nine of the 16 nonresidential categories. Private nonresidential spending was up 1.7%, while public nonresidential construction spending was down 0.1%.

Spending in three of the five biggest categories of nonresidential construction spending – all clipping along at annual rates of more than $100 billion – increased in November. Manufacturing, currently largest of the nonresidential categories, jumped 6.4% and actual spending year-to-date in the category has soared a whopping 33.6% over the 2021 period.

“The average nonresidential contractor starts 2023 with considerable backlog,” said Associated Builders and Contractors Chief Economist Anirban Basu. “Not coincidentally, contractors also have significant confidence regarding current-year prospects, according to ABC’s Construction Confidence Index, which indicates expectations for growth in sales and employment with margins remaining stable.

“November’s construction spending report suggests that this confidence is warranted,” said Basu. “However, there are countervailing considerations. First, growth in nonresidential construction spending in November was not especially broad. Much of the growth came from the manufacturing category, which is partially attributable to construction related to large-scale chip manufacturing facilities. The balance of growth came mostly from conservation and development, which includes flood control expenditures.

“Second, backlog could dry up,” said Basu. “Anecdotal evidence suggests that banks are more cautious in their lending to the commercial real estate and multifamily segments. Fears of recession this year remain pervasive in an environment characterized by high and rising interest rates. It will be interesting to see how well backlog will hold up as contractors continue to build and the economy heads toward what is likely to be a Federal Reserve-induced recession.”

Nonresidential politics

(Data: U.S. Department of Commerce)

(Data: U.S. Department of Commerce)

“A variety of private nonresidential categories, as well as multifamily projects, posted solid spending gains in November,” said Ken Simonson, the Associated General Contractors of America’s chief economist. “Many of these segments should continue to do well in 2023. But the timing of public construction, while well-funded, remains unclear.”

The five largest nonresidential construction spending categories also included a 1% drop in November spending on highway and street construction.

“Much of [our] outlook is predicated on the assumption the administration will work to accelerate infrastructure projects in 2023,” said Stephen E. Sandherr, AGC’s chief executive officer. “That is why the administration should address the regulatory confusion it has created and get work on infrastructure projects started as quickly as possible.”

Spending on highway and street construction has jumped nearly 15% since the Infrastructure Investment and Jobs Act was signed in November of 2021, and actual public spending year-to-date on highways and streets is up 8.1% compared to the same period of 2021.

Another mostly public infrastructure category that AGC calls out for its November drop is water supply projects. The annual spending rate there fell 1.9% to $25.1 billion. Public spending on water supply is nearly 32% above November 2021, and year-to-date leaped 19.3% over the first 11 months of 2021.

CONNECT WITH THE TEAM