Trendlines: rental dominance in North America

14 November 2024

Rental companies buy a third of all construction equipment sold in North America. In 2023, that added up to almost 110,000 pieces of compact, earthmoving and materials handling equipment, swelling the fleet owned by rental companies to more than 820,000 construction machines. On top of that, the industry owns over 500,000 aerial work platforms (AWPs) besides many other types of machinery.

Source: International Rental News

Source: International Rental News

That means North America certainly has the largest fleet of rental equipment of any country in the world, if only because of the sheer size of the market.

However, there are parts of the world where the penetration rate for rental is much higher. It is close to 70% in the UK for example, and other European markets like France see a penetration rate which is similar or slightly higher than North America’s (as does Japan).

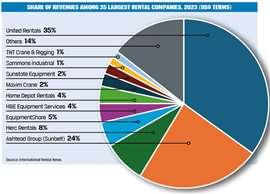

But the area where North America clearly leads is in the size of its biggest rental chains. The International Rental News IRN-100 of the world’s largest rental companies, shows that the three largest rental companies in the world by revenue are North American (albeit Sunbelt is owned by a UK company). Below the top three of United Rentals, Sunbelt and HERC, there are three more North American chains in the global top 10: EquipmentShare, H&E Equipment Services and the Home Depot network.

The biggest rental chain outside the U.S. is France’s Loxam, which is a fifth of the size of United Rentals by revenues.

Consolidated market

Another way to look at it is that North America is arguably the most consolidated rental market in the world. The fact that it is the major rental companies that do the consolidating (particularly United Rentals) means that the big companies grow faster than the rest of the bunch.

Chris Sleight, managing director, Off-Highway Research.

Chris Sleight, managing director, Off-Highway Research.

In North America, achieving this seems to require big rental companies to be stock market quoted to gain the access to capital a listing provides. Analysis of the IRN-100 data for North American companies shows that some 80% of rental revenues are earned by public companies. Large private companies tend to be either the big crane rental specialists or companies that are dealers first and foremost with a rental business supplementing their core activities.

Having said that, dealer- or OEM-controlled rental is less than 10% of the market in North America. The majority of activity is carried out by independent rental houses.

The information in this article is taken from Off-Highway Research’s new report on the equipment rental industry in North America. For more information, visit www.offhighway-store.com

CONNECT WITH THE TEAM