Finance and CE Barometer September 2020

27 October 2020

This article assesses the eight-week period between week 31 and 39 (July 31 – September 25).

During the period there has been a significant return to growth for a lot of companies, most notably equipment manufacturers, but there has also been a substantial number of firms whose share price has continued to plummet, chiefly contractors.

It was mentioned in our last financial round up that contractors were telling us that the number of new contracts were declining during these unprecedented times, and that some companies were reliant on their existing order books.

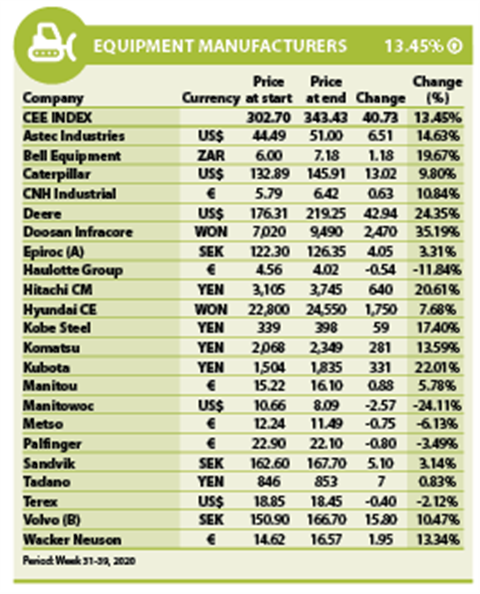

Curious, then, that original equipment manufacturers (OEMs) would see such a resurgence. Sales are inevitably driven by increased work for contractors but the two stand in stark contrast with the CEE Index figure for equipment manufacturers at +13.5% and the CEC Index figure for contractors at -27.43%.

Manufacturers

During the examined eight-week period, 17 of the listed manufacturers increased in share value, while the remaining four declined at varying degrees of severity. The most notable decline was experienced by US crane manufacturer Manitowoc (-24.11%), a company which has had its share of financial difficulties of late.

Manitowoc reported a second-quarter loss due to a decline in sales and reduced manufacturing activity. Net loss was US$12.7 million on sales

that were down 35% year-on-year. Aaron Ravenscroft, new president and CEO of the company, said, “Our second-quarter adjusted EBITDA of $7.8 million reflected good operational performance and was in line with expectations, considering the vast challenges posed by the ongoing Covid-19 pandemic.”

The company will not provide full-year guidance for 2020 due to market uncertainty from the impact of the pandemic.

So how are other OEMs managing to sustain some margin of growth? The largest return to growth was seen by Doosan Infracore (+35.19%).

The secret of the South Korean company’s success during this time is no mystery, as a 36.27% stake in the company is up for sale by Doosan. Interest has been shown recently by big industry player and fellow Korean firm Hyundai, which is itself up 7.68% during the period.

The next best performing OEM is US firm Deere. The company is due to pay its next dividend per share, equating to US$0.76 (€0.65) per share, on 9 November. The company will trade on markets ex-dividend past 29 September, meaning shareholders that purchase on or after that date will not receive the dividend payment.

Contractors

In the last eight-week period examined by CE (weeks 23 – 31), the CEC Index figure fell by 16.59%. It appears that the Covid-19 situation has badly affected investor confidence in contractors and the latest drop of 27.43% only accentuates the fact.

This fall in share value is in line with predictions from the Euroconstruct Summit, which anticipated revenue reductions of €350 billion between 2020 and 2022.

Euroconstruct has combined figures from its 19 European member nations, resulting in a forecast of an average 9% decline by the end of 2020.

The UK is predicted to be the market hardest hit by the coronavirus pandemic, but Nordic countries are remaining stable, with the total market in 2021 (bar Sweden and Finland) expected to return to around the level of 2019.

The Netherlands, the UK and Spain are expected to be the slowest to recover, while Euroconstruct’s figures show Poland currently seeming ‘crisis-resistant’, with constant growth anticipated between now and 2022.

In total, 19 listed contractors declined in value, while 11 managed to grow over the two-month period.

The largest decline in share value was experienced by Italy-based Trevi group (-36.36%). The company posted revenues of €238.4 million for the first half of the year, down 21% on a year-on-year basis. The company did, however, see an improved EBITDA of €34.3 million, up by 43% on the same period last year.

The CEO of Trevi group, Giuseppe Caselli, said, “Despite the unexpected and devastating spread of the pandemic it was possible to complete capital strengthening of the company thanks to the sale of Oil & Gas and to improve the Recurring EBITDA and EBIT compared to the previous year.”

Materials Producers

The majority of companies increased in share value with nine listed companies seeing sustained growth in value over weeks 31-38.

The materials industry seems to be the least effected by the uncertainty caused by the pandemic when it comes to the three examined sectors.

The CEM Index figure for last month only increased by a marginal 0.18% but has grown over the most recent period to a strong +5.93%.

Of the listed producers, Mexican company Cemex, was the best performing outfit (+17.16%). In the not-so-distant past the company was suffering value decreases in almost every period and dropped by 45% in value during March 2020.

CE Barometer: September survey results

For the month of September, the CE Barometer respondents were most upbeat about activity on a month-on-month basis. A balance figure of 23.3% for September indicates that, after August’s lesser activity gains, businesses experienced a better month in general than they had previously.

Note: The balance figure is the percentage of positive responses minus the percentage of negative responses.

Another notable fact this month is that the CE barometer survey was answered by a spike of equipment manufacturers; approximately 38.33% of all respondents were from manufacturing firms, with a further 20% made up by dealers, distributors and rental companies.

In comparison with the same month last year, September 2020 was agreed by the majority of respondents to be worse in terms of business activity. This was represented by a balance figure of -30%.

When compared with the expectations of respondents in September 2019 the current climate is 23.2% worse for business activity.

Looking ahead to September 2021, however, a strong 61.7% of respondents are certain that activity will be better than it currently is. A positive balance figure of 45% suggests that, although some have concerns for the future of the construction industry, the consensus surrounding next year is positive.

Last month, there were many mixed reactions from respondents. Covid-19 was reported as the main reason for negative impacts on businesses, particularly in that it was causing travel disruptions. Others stated that they were beginning to see activity moving in the right direction.

CONNECT WITH THE TEAM