Euroconstruct issues forecasts for 2021-23

26 November 2020

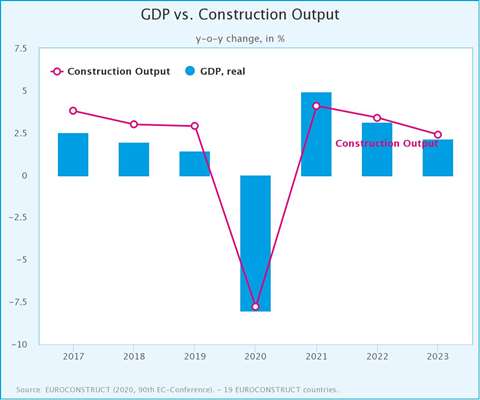

European construction forecasting body Euroconstruct said Europe’s construction market will shrink by 7.8% this year and will not recover fully until 2023, with forecast growth of 4.1% in 2021, 3.4% in 2022 and 2.4% in 2023.

The forecast for this year is an improvement on previous estimates of -11.5% made in June and -9.1% in August. Total construction output is expected to reach €1.73 trillion in 2023, which will exceed by €28 billion the pre-corona level of 2019.

The overall figures - published during Euroconstruct’s annual conference on 23 and 24 November - hide significant differences between countries, ranging from modest growth in Finland and stagnation in Portugal and Norway to a sharp decline of almost 20% in the UK in the current year.

Other major markets like France and Spain are also strongly affected, while the German market performed well because construction activities were able to continue relatively unhindered through the pandemic.

The civil engineering sector is likely to be least affected by the crisis, said Euroconstruct, with spending on infrastructure falling by only 3.8% this year and expanding by 5.2% next year.

The negative consequences for building construction will be significant, however, with a 9.2% fall estimated for non-residential construction this year followed by a moderate gain of 2.5% in 2021. Even by 2023, the activity level of 2019 is unlikely to be reached.

For residential construction, after a big decline of 8.6% in 2020, the market will regain significant momentum in 2021 with an expected growth of 4.7%.

The forecasts are based on the assumption that the economy in the Euroconstruct area – comprising 18 countries - will shrink by 8.0% in 2020 and grow by 4.9% in 2021.

The organisation said lockdown measures made forecasting difficult, but added; “the direct impact on the construction industry should be much less severe than in Spring 2020. The situation for construction companies, clients and authorities is no longer entirely new and most construction sites should remain open now because, compared to the period March-May, there are already many protection measures in use and the digital working procedures are practised.

“But indirect negative effects of the pandemic must be considered, as well. Already the first lockdown caused economic damage such as rising unemployment, reduced turnover or tax losses which will be felt in the coming months.

“While these are not yet fully foreseeable, the European economy is now threatened by a second blow, although partly this may be less severe. Much will also depend on how well the government relief/stimulus programmes work.”

CONNECT WITH THE TEAM