Class 8 net orders jump in September

03 October 2024

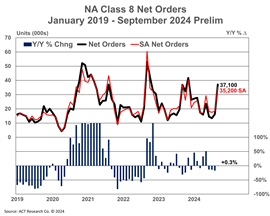

After a weak August in which North American Class 8 net orders totaled just 16,249 units – down 14% year over year (y/y) – the preliminary net orders for September show renewed strength, doubling last month’s intake to reach 37,100 units (+0.3% y/y), according to ACT Research’s latest data.

Weakness in Class 8 orders in August were concentrated in vocational units, which are more sensitive to interest-rate sensitive spending, the State of the Industry: NA Classes 5-8 report indicated. While down substantially for the month, the decline came off of unseasonally high sales in July, leading Kenny Vieth, ACT president and senior analyst, to surmise that the decline was the industry moving toward normalization.

“A year ago, the total Class 8 inventory was 61,800 units. At the end of July 2024, the Class 8 inventory was a record 88,800 units, an increase of 27,000 units y/y. The increase has not been supported by demand, pushing stocks significantly above an inventory-to-retail sales inferred level,” Vieth stated. “The same exercise works in the MD market. as well. From a near-record 77,800 units in July 2023, July 2024 ending stocks had risen to a new record 101,900 units, an increase of 24,100 units y/y.

“While inventories are ultimately a headwind,” he continued, “the path of orders is foundational at this juncture: backlogs are low, and BL/BU ratios for Class 8 and trailers indicate unsustainable production levels relative to backlog support. Strong orders in Q4 and into Q1 are imperative.”

As of mid-September, Veith believed the industry was “sitting in the lull before a hoped-for sustained surge as ‘order season’ gets underway.” September is the first month in which OEMs open their order books to next year’s orders, he said, though the season tends to get underway in earnest starting in October.

Preliminary net orders for Class 8 vehicles for the month have exceeded expectations, however. “Class 8 orders jumped well above trend and seasonally elevated expectations in September,” said Veith. “On a seasonally adjusted basis, Class 8 orders jumped 92% from August to 35,200 units, a 423k SAAR.”

Medium-duty net orders did not fare as well. Orders rose slightly month over month but fell seasonally. As of September, net orders were down 20% y/y to 19,100 units.

Complete industry data for September will be published in mid-October.

CONNECT WITH THE TEAM