2024 d&ri100 shows demolition sector’s resilience in turbulent times

02 January 2025

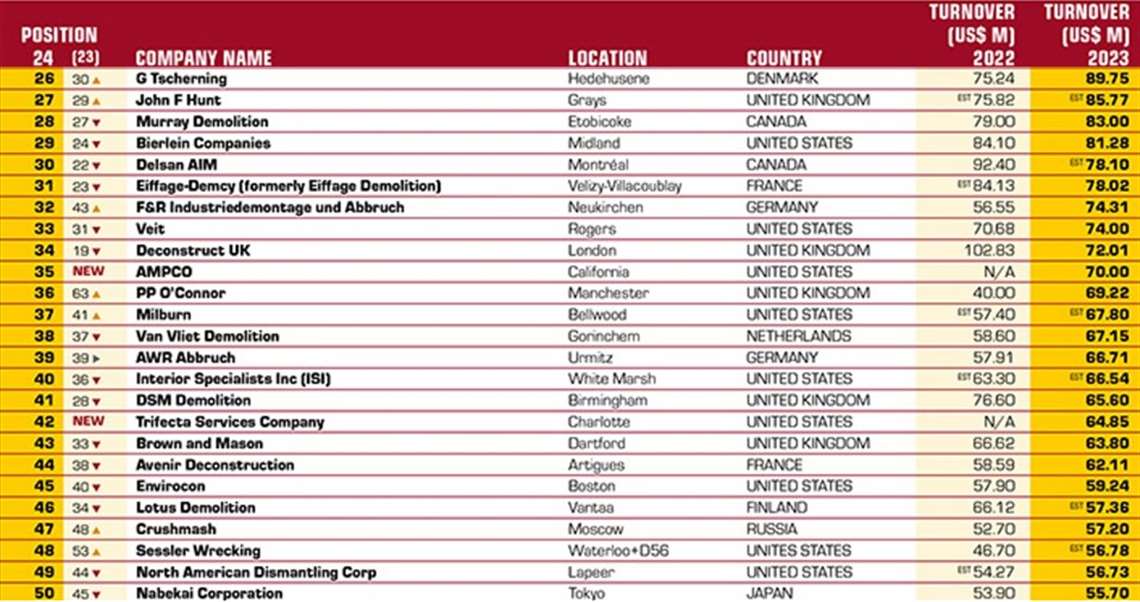

The 2024 d&ri100 ranking reveals that the world’s largest demolition contractors continued to grow in 2023, despite a complex global environment marked by rising costs, inflation, and declines in construction activity.

With a combined turnover of $8.2 billion – an increase from $7.7 billion in 2022 – the sector demonstrated a level of resilience that reflects its adaptability, commitment to sustainability, and ability to meet shifting demands across global markets.

Growth in a Downturn Market

The nearly $500 million increase in turnover from the previous year highlights how leading demolition companies have positioned themselves to capture new opportunities.

This growth is noteworthy in light of the recent construction activity slowdown, especially in regions such as Europe where economic pressures have been significant.

While North American contractors have been buoyed by infrastructure spending, new environmental regulations in Europe continue to present challenges for smaller European firms.

Although challenges persist, the sector’s turnover increase points to a core of financial and operational flexibility that has allowed companies to withstand and even thrive in adverse conditions.

This upward trend reflects the essential role of demolition in critical infrastructure renewal, sustainable building practices, and urban redevelopment.

Regional Variations

In Europe, contractors collectively accounted for approximately $4.3 billion in turnover, making up the largest share of the global demolition market.

Sustainability has driven contractors to invest in eco-friendly practices and advanced equipment. Hagedorn, based in Germany, is one example, specialising in the dismantling of industrial buildings, power plants, and chemical facilities, with services that include on-site dismantling and structural analysis.

This focus on environmentally conscious demolition aligns with Europe’s tighter regulations on emissions and material recycling, positioning European contractors to lead in sustainable practices.

North America contributed roughly $3.5 billion to the D&Ri100 total, supported by significant infrastructure spending and public projects. Contractors in the U.S. and Canada continue to benefit from federal investment, particularly under the Infrastructure Investment and Jobs Act, which has provided a steady pipeline of public projects.

Shifting focus

Dickson Company in the U.S. responded to a slowdown in private-sector activity by pivoting towards federal and state-funded work, securing projects such as large campus demolitions.

This adaptability is indicative of a regional shift toward government-backed contracts as a reliable revenue source.

Meanwhile, contractors in markets such as South America and Asia are capitalizing on increasing industrial activity. Flesan from Chile stands out with its work on large-scale industrial closures and mining projects, including the Pierina mining site in Peru.

The company’s recent acquisition of asbestos detection technology further emphasizes a commitment to health and safety compliance in emerging markets. As urbanisation continues in these regions, demand for demolition services is expected to grow in the long-term, offering international contractors new areas for expansion.

Financial Performance

Despite higher input costs, some contractors have managed to improve profitability by taking on strategic projects. Hughes & Salvidge in the UK reported a substantial increase in turnover, rising from £30.6 million to £41.8 million, along with an improved gross margin.

The 2024 D&Ri100 ranking underscores the demolition industry’s adaptability and technical growth. By diversifying project portfolios, modernizing fleets, and embracing sustainable practices, contractors are well-prepared to navigate the challenges and opportunities of the year ahead.

CONNECT WITH THE TEAM